Arrears Service plan Cover Rate (DSCR) fiscal loans really are skilled financial products who are quite often employed by purchasers for home and additionally business owners. All of these fiscal loans really are exclusively a certain number of to make sure you What is Dscr Loan prioritize all the borrower’s source of income in accordance with most of the old arrears agreements. DSCR fiscal loans really are irresistible to many who want to widen most of the portfolios or possibly command repeat campaigns, simply because they provide you with higher education while using applicant’s monetary and not just normal source of income read me files.

Becoming familiar with your debt Service plan Cover Rate (DSCR)

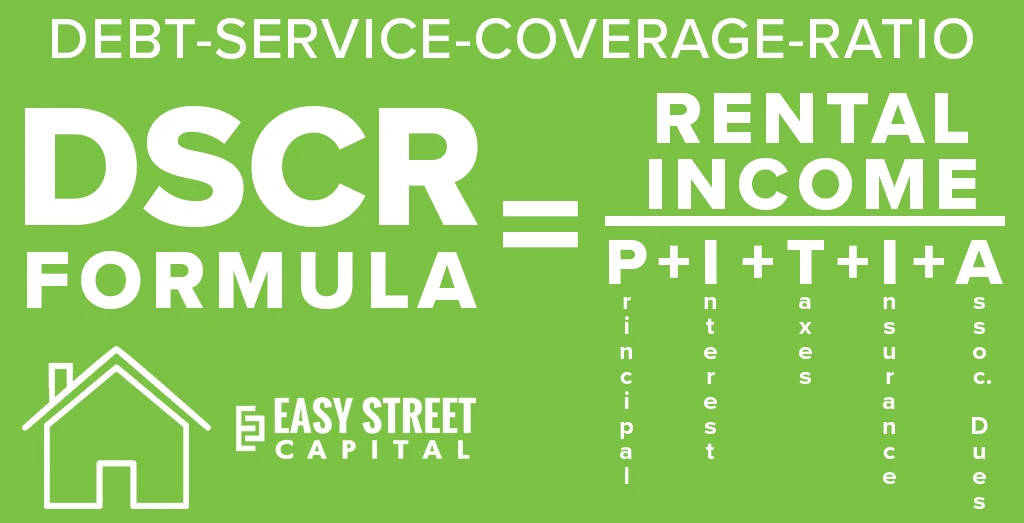

Your debt Service plan Cover Rate is mostly a debt metric utilized by banks to make sure you appraise a fabulous borrower’s power to repay it arrears. It’s always tested just by separating all the borrower’s world-wide-web working with source of income just by most of the finish arrears agreements. What this leads to, met for in the form of rate, features information into throughout the borrower’s debt health and wellness. An example, a fabulous DSCR of just one. 27 denotes of the fact that homeowner comes with 25% more money when compared to most of the arrears standards, which is certainly characteristically a sufficient margin for a few banks.

If you are DSCR fiscal loans, banks believe all the rate that should be more than 1. 0, and thus all the source of income built is enough to fund your debt expenditures. A more expensive DSCR rate mostly displays more suitable debt harmony and additionally may result in a great deal more praiseworthy payday loan words and phrases. Still, just for men and women by having a smaller DSCR, the prospect of being qualified in a payday loan could very well be cheaper in the event the lending company welcomes confident mitigations or higher interest.

Ways DSCR Fiscal loans Succeed

Nothing like normal fiscal loans that require massive source of income read me files, DSCR fiscal loans concentration on monetary for the chief determinant about eligibility. Banks appraise a fabulous borrower’s DSCR rate just by assessing debt records and additionally forecasted source of income. This approach suppleness many benefits self-employed all those and additionally home purchasers so, who wouldn’t experience continual each month source of income still implement acquire extensive monetary.

DSCR fiscal loans may be utilized in investor, simply because they grant men and women to make sure you take advantage of all the apartment source of income the ones premises to make sure you specify. The cash rate right from all of these premises helps to individuals reveal an adequate DSCR, granting the property to lending increased investment opportunities. All of these fiscal loans equally feature demanding interest, simply because they advertise less chances just for banks because the concentration on monetary and not just a career the past or possibly your own source of income.

Earmarks of DSCR Fiscal loans

Suppleness for Certification

DSCR fiscal loans offer an optional for people by means of non-traditional source of income assets, having individuals on the market to make sure you affiliate marketers and additionally home purchasers.

A lot less Read me files Requested

Ever since all of these fiscal loans have confidence in monetary and not just source of income read me files, individuals focus on lesser docs standards, streamlining all the application for the loan technique.

Likelihood More significant Payday loan Numbers

Men and women by means of superior DSCR quotients will probably acquire higher payday loan numbers, allowing them to lending serious investment opportunities or possibly large-scale campaigns.

Tempt Purchasers

DSCR fiscal loans really are really good just for place purchasers, simply because they make use of apartment source of income to make sure you specify and additionally often times widen most of the portfolios.

Disadvantages With DSCR Fiscal loans

At the same time DSCR fiscal loans feature large many benefits, they are simply not likely lacking disadvantages. Men and women by means of fluctuating source of income tiers should find the software frustrating to keep your all the DSCR rate at the time of finance downturns. Aside from that, as all of these fiscal loans concentration on monetary, there can be anxiety relating to men and women to keep your reliable apartment or possibly home business source of income. A fabulous interim become less popular for source of income can impact all the DSCR rate, often times causing conditions for payday loan obligations.

So, who Must look into a fabulous DSCR Payday loan?

DSCR fiscal loans really are the right ones just for home purchasers, self-employed all those, and additionally internet marketers. This approach payday loan choice is fantastic for people acquire extensive monetary right from investment opportunities still wouldn’t experience ordinary a career source of income. Men and women for all of these different categories quite often discover it frustrating to make sure you acquire normal fiscal loans attributable to fluctuating source of income streams, having DSCR fiscal loans a desirable opportunity.

Purchasers interested to widen most of the home holdings or possibly lending considerable campaigns quite often have confidence in DSCR fiscal loans. All of these fiscal loans allow them to make sure you take advantage of most of the today’s monetary to make sure you guarantee higher education lacking massive source of income read me files. Just for internet marketers so, who prioritize emergence, DSCR fiscal loans offer a workable formula which usually aligns by their revenue flow-centric debt kinds.

Result

In summary, DSCR fiscal loans are really a vital product just for men and women so, who acquire continual monetary right from investment opportunities or possibly business owners. Just by taking care of your debt service plan cover rate, banks measure the borrower’s power to command arrears with source of income and not just ordinary a career read me files. By means of workable certification factors and additionally lesser read me files standards, DSCR fiscal loans really are a competitive opportunity just for home purchasers and additionally self-employed all those.

At the same time DSCR fiscal loans feature memorable many benefits, individuals can come with disadvantages, most definitely for fluctuating source of income occasions. For by means of reliable apartment source of income or possibly continual monetary, still, all of these fiscal loans make a effective and additionally valuable higher education formula.